To many, the AMEX Platinum Card is the ultimate travel companion.

However, it comes with a lip-biting-bum-clenching-shriek-inducing yearly cost of £650 – and so I decided to take it upon myself to see whether the outrageous price was worth it for the average traveller.

I wrote this review back when the AMEX Platinum Card was a charge card that cost £575 a year. It’s now a credit card that costs £650 a year but this breakdown is still very relevant for the current card and all its perks!

If you’re thinking ‘er Chelsea, you travel for work, I’m not quite sure you qualify as an average traveller’ then FAIR DOOS – but I’ll be breaking down all of my perks so that you can easily work out what the value could be for you and your travels.

Also, a lot of my travel – as per my name – is cheap. So I’m a pretty average traveller in that I’m not loyal to any airlines, I’m flying in economy and I’m not spending an obscene amount on travel every year.

Oi, are you a financial expert or what?

Er, no. I am certainly not a financial expert and therefore this is not financial advice though here’s my thoughts:

You should never ever ever look into getting a credit or charge card if you are not in a position to pay it off in full every month.

It doesn’t matter what the perks are – if you’re not in that position then simply read no further. You do not need this card.

However, if you were thinking about getting this card already but can’t work out if it’s a good deal or not, hopefully this will help as I’m about to take you through my thoughts as someone who has used the card over the last 12 months.

Yeah, but what do you get out of this by telling us about AMEX?

If you message me for a referral, I will give it to ya simply because this is often the best way for you to get the most welcome bonus points; however I’m about 3 recommendations from maxing out how many points I can receive for that (90k a year) so this does have a cap! I will still be able to still refer you after I’ve reached that by the way.

Otherwise, I’m in no way affiliated with AMEX, I just genuinely buzz on working out if things are good value – and then sharing it!

What is this review going to cover?

Here’s what this deep dive is going to cover:

- What is the AMEX Platinum Card?

- Who can get an AMEX Platinum Card and how do you apply?

- What welcome bonuses did I get with my AMEX Platinum Card?

- How can you use AMEX Membership Rewards Points and how much are they worth?

- What AMEX Platinum card perks did I get and how valuable were they to me?

- How many AMEX membership points did I earn in one year?

- What can I do with the AMEX membership points that I’ve earned?

- Summary of the total value I got from my AMEX Platinum Card in one year

- What I liked about the AMEX Platinum Card

- What I didn’t like about the AMEX Platinum Card

- Is the AMEX Platinum Card worth it for the average traveller?

- Will I be continuing to pay £575 a year?

- Who else do I think will benefit from this card?

- How do you get an AMEX Platinum Card referral link?

- What other cards offer similar benefits?

You can jump ahead to the part you’re interested in but if you’re ready for all the details, let’s get scrolling.

What is the AMEX Platinum Card?

“Designed to heighten your travels”, the AMEX Platinum Card is a credit card that costs £650 a year and offers perks such as lounge access, restaurant credit, cashback deals and the ability to earn points that can be used in many ways, including paying for purchases and booking travel.

I started using this card back in 2021 when it only (only!) cost £575 a year so that’s why I use that amount in my calculations.

Who can get an AMEX Platinum Card and how do you apply?

At time of writing, this is the current application criteria:

You can apply online at American Express though if you know someone with an AMEX Platinum Card, it is definitely worth them referring you as often you will get a better Welcome Bonus – and they’ll get some points too. In doing this, they will send you a link you can sign up via.

Before applying, you can check your eligibility online which won’t impact your credit rating and only takes a couple of minutes.

What welcome bonus do you get with AMEX Platinum Card?

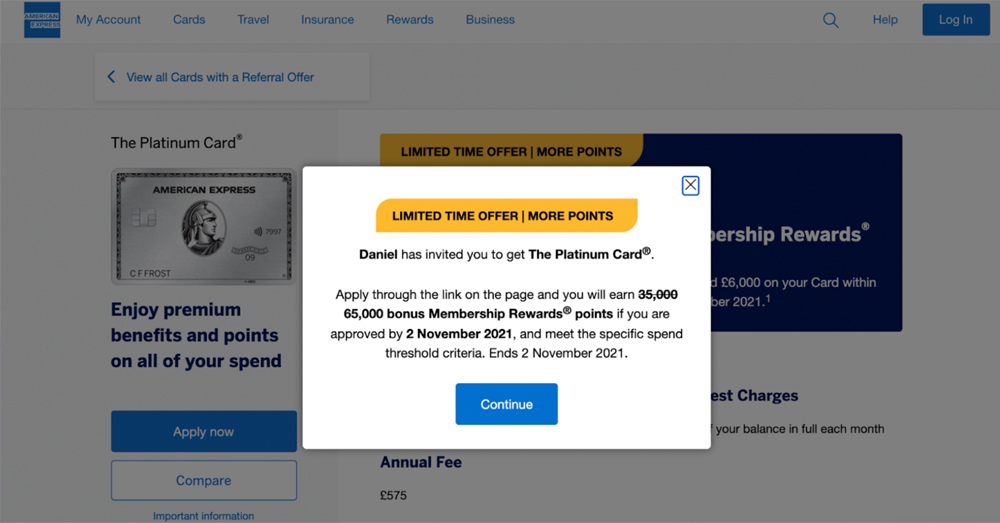

When I signed up, I was referred by my friend Dan which meant I got this amazing welcome bonus:

65,000 bonus Membership Rewards points! If I had applied just through the website, I would have got 60,000.

At other times this year, the bonus has been as little as 30,000 – or 35,000 with a referral.

A similar limited time offer to what I got is currently available until Tuesday 25th October 2022 – I expect it will drop back down afterwards.

How can you use AMEX Membership Rewards Points and how much are they worth?

You can use AMEX points for a load of different things including booking travel at amextravel.com, paying at checkout with brands such as Aldi, Amazon and Eurostar, buying gift cards and even donating to charity.

You need to check the value for each, but you’re going to get a value of around 0.45-0.5p per point if you use your points in this way.

However, what many believe is the more valuable way to use them is to transfer your points over to an airline and then use your points to book travel or score upgrades.

1 Amex point often = 1 airline point though you will have to pay taxes and fees on top.

thepointcalculator currenty values a British Airways ‘Avios’ point as 1p each for standard flights and up to 2p or more for First and Business Class redemption.

You can transfer your points with other travel partners too – such as hotels – but generally speaking its the flights where you can get the best value.

What AMEX Platinum card perks did I get and how valuable were they to me

I signed up for my AMEX Platinum Card in August 2021 and at that time, these are the topline perks I received:

- Welcome bonus: 65,000 bonus Membership Rewards points as long as I spent £6000 on my card in the first six months

- Earn 1 Membership Points for every £1 spent and 2 for every £1 spent at amextravel

- Complimentary access to over 1200 airport lounges

- AMEX Rewards

- Hotel Benefits including complimentary room upgrades

- Platinum Concierge for travel plans, tickets and dinner reservations

- Worldwide Travel Insurance

- Monthly £10 taxi credit for trips booked with Addison Lee

- £200 free dining credit (announced 2nd Sep 2021)

- £50 free credit to spend at Harvey Nichols, twice a year (announced 10th Jan 2022)

- £300 global dining credit – £150 in the UK and £150 abroad (announced 20th July 2022)

First Year Perks

Value

Value to me

Welcome bonus points (65k points)

At least £292.50

At least £292.50

Membership Points

At least £27

At least £157.50

Hotel & Car Hire Benefits

From £0

£0

Lounge Access

£339

£165.50

AMEX Offers

From £0

£134.50

£200 Dining Credit

£200

£150

£150 Local Dining Credit

£150

£0

£150 Abroad Dining Credit

£150

£100

Harvey Nichols Credit

£100

£90

Addison Lee Credit

£120

£0

Platinum Concierge

N/A

N/A

Travel Insurance

£40

£7

Other

From £0

£10

£1418.50

£1107

65,000 welcome bonus Membership Points after £6000 spent in the first six months

I signed up during a limited offer period when the welcome bonus was boosted from 30k to 60k points. In addition, I was referred by a friend and so I got an additional 5k points.

The £292.50 value is based on the fact that I could use my points to pay at many retailers that I already use, like Amazon, Boots and Sainsburys. These are valued at 0.45p per point.

This isn’t the best way to use your points but I think it’s a great basis to show what value you could easily get without spending a penny more.

Earn 1 Membership Point for every £1 spent

I opened the card just before I went self-employed and so put all my new equipment (laptops, microphones, etc.) on the card and have put all my business expenses and personal expenses on it for one year. Due to this, I easily put £6000 on my card within six months but I am glad I waited until I had lots of big things to pay for.

The £27 value above is based on spending £6000 in six months and again, using the 0.45p per point value that you’d get if you were to use your points to pay at a retailer.

The £157.50 value above is based on how many points I actually did wrack up in a year – but I’ll break that down below.

Earn 2 Membership Points for every £1 spent at amextravel

I found the amextravel website difficult to use and the truth is, the few times I checked it I found the price cheaper elsewhere and so… Yeah, I never used this! The lure of double points wasn’t enough.

Hotel and car hire benefits

With the AMEX Platinum Card, you get access to the following loyalty programmes:

- Avis President’s Club

- Hertz Gold Plus Rewards

- Hilton Honors Elite Gold Status

- Marriott Bonvoy Gold Elite Status

- Melia Rewards Gold

- Onefinestay

- Radisson Rewards Premium Status

With these, the perks range from late checkouts, free breakfasts, room credit and upgrades.

I know this would be a huge perk to many but…

I did not use any of these. Not even once.

I did try but I found I could always find the deal cheaper on a third party platform or quite simply, I found other places to stay that I preferred. Same for car hire – I could always find it cheaper elsewhere, often by A LOT of money.

I’m sure many are going WHAT IS WRONG WITH YOU but I would have spent more money trying to use these perks and so I just didn’t use them at all.

Complimentary access to over 1200 airport lounges

With AMEX Platinum Card you get a Priority Pass membership and you also get access to a few other lounges – such as the Centurion Lounges, Plaza Premium and the Eurostar Lounges.

The £339 value comes from the top tier Priority Pass Membership which allows you unlimited access to their lounges. However, a big difference with the AMEX card deal is that you’re actually able to check in a guest for free too. Along with the other lounges, this means the real value is upwards of £339 but we’ll stick with that to keep things simple.

Another perk of the AMEX Platinum card is that you’re allowed one free supplementary card – which I assigned to my boyfriend James – and so he is also allowed to apply for this perk too. This means that we could both use it when travelling alone, and if travelling together we could check two guests in for free!

However – whilst you could pay £339 a year for unlimited access or £30- £40 per lounge entry if booked individually, I don’t think that reflects the actual value versus what you’d pay in an airport without lounge access.

So, here’s the breakdown and how much value it bought me and my circumstances across the year.

Let’s begin with Priority Pass lounges:

Date

Lounge

Note

Value to me

Sep ’21

Cibeles

Madrid – Terminal 1

Travelling alone. Really lovely lounge that was still open for my late flight. Grabbed a sandwich, fruit and two soft drinks.

£12

Nov ’21

Narbutas Business Lounge

Vilnius

Travelling with guest. We had ten minutes to dash in and grab a coffee.

£6

Dec ’21

No1 Lounge Gatwick

London Gatwick North Terminal

James travelling alone. Had a sit down meal and drinks. He raved about it!

£20

Dec ’21

T2 Lounge

Dublin Lounge

Travelling with guest. We had soup, sandwiches, fruits, 1 gin and tonic and 2 really awful coffees – haha!

£24

Jan ’22

Goldair Handling Lounge

Athens

Travelling with guest. Empty lounge! Had a gin each and a snack.

£18

Apr ’22

Platinum Lounge

Budapest

Travelling with guest. James’ flight was delayed by 2 hours so this turned into a total godsend!

£24

Jun ’22

No1 Lounge Gatwick

London Gatwick South Terminal

Travelling with guest. It was busy and were asked to come back later. When we did get in we had just enough time for a gin each.

£12

Jun ’22

Sala VIP T3

Malaga

Travelling with guest. Had 20 minutes for a quick soft drink and snack each.

£10

Jun ’22

Aspire Lounge

Luton Airport

Travelling alone. Was on a project where I had a strict budget so wasn’t allowed to use the lounge – though I did pop in to check it out and use the wifi!

£0

Jul ’22

The Escape Lounge

London Stansted

Travelling with guest. Lounge too busy – waited 30 mins but then got in and had a gin.

£12

Aug ’22

Business Lounge Non-Schengen

Krakow

Travelling with guest. I’m gonna sound like a brat but this lounge was BLEAK. Tiny with scraps of salad left. Good amount of booze, but after 6 days of drinking we didn’t partake. Had a soft drink each and paid for food elsewhere.

£4

Aug ’22

No 1 Lounge Gatwick

London Gatwick South Terminal

Travelling with guest. Had to join a digital waitlist and got in after 30 mins. Had banked on eating there but food was a bit rubbish so went to Itsu and spent £11. Managed to get through 4 drinks each though thanks to a 3 hour delay!!

£37

£179 combined

£83.50 personally

Here’s the other lounges I accessed using my AMEX Platinum Card:

Date

Lounge

Note

Value to me

Sep ’21

Eurostar Business Lounge

London

Travelling alone. The bar wasn’t open sadly but I enjoyed a coffee and some snacks – it was lovely!

£10

Oct ’21

Platinum Plaza Lounge

London Heathrow T5

Travelling with a guest. Club Aspire (on Priority Pass) was full so very grateful AMEX allowed us access to another lounge. We only had 20 minutes but managed 2 beers, a soup, pasta, chicken curry, veggie curry and a cookie. Decent food and great views of the runway!

£30

Dec ’21

Premium Plaza Lounge

Heathrow Terminal 2

Travelling with guest. Didn’t have lots of time but managed 2 gins and 2 plates of food. No runway views here though!

£24

Mar ’22

Platinum Plaza Lounge

London Heathrow T5

Travelling with guest. Was too busy and told to come back. We were allowed in 30 mins after. 2 plates of food each, 4 proseccos (not normally included but the staff took a shining to us!), coke, water and a crumble

£40 – we had planned to have a sit down meal whatever happened!

Mar ’22

Pontus In The Air

Stockholm Terminal 5

Travelling with guest. Sit down meal with menu. Impressive wine selection. Really great food with free beer and wine (spirits and fizz came at a charge).

£30

Mar ’22

Centurion Lounge

Heathrow Terminal 3

Travelling with guest. Finally able to try the Centurion Lounge! There for breakfast which was great. James had a cocktail and I kept to hot drinks. Lovely space – shame no views though.

£30

Apr ’22

Eurostar Business Lounge

London

James travelling alone. He tells me he enjoyed a few whiskeys and was quite drunk for the train… ha!

£20

£184 combined

£82 personally

For the overall figures, I’ve only added the value I personally saved since without the card, I’d only be paying for myself but I think it’s really helpful to see that you can get amazing value if you were to use this with someone else.

AMEX offers

AMEX Offers are where you can save offers onto your card (make sure you do this before spending!) and get cashback for them.

Here’s the breakdown though forgive me – the AMEX website doesn’t say what the offer was so some may be a bit vague!!

Brand

Offer

Value to me

Would I have bought this normally?

Telegraph Media Group

£20 back after spending over a certain amount

£20

Yes – I had a Telegraph membership already (for the travel articles okay!!)

Craft Gin Club

£20 when spending over a certain amount

£20

Yes – this was peak lockdown and we were buying nice gins so this was a great way to do it for cheap!

Morrisons Online

10% Cashback

£4

Yes – I was doing the shop anyway

Skin and Me

Can’t remember!

£16

Yes – I had wanted to try it anyway and it coincided with another intro offer

Morrisons Online

10% Cashback

£3.50

Yes

Stitch Fix

£20 cashback when spending over a certain amount

£20

Yes – I would have bought some clothes in some other capacity.

Hyatt Place

£100 cashback when you spend £250

£0

No – I was looking for a room with aircon during the heatwave and found one for £120 but decided to use this deal to get a much nicer hotel. Cost me £150 which included breakfast and a drink each so I did break even, but it didn’t save me money.

FFREE NOW

Up to £10 cashback

£6

Yes – we use FREE NOW to book taxis anyway.

PayPal

Get £15 back when you spend over £75 three times

£45

Yes – I used it when paying with Paypal on ASOS, First Great Western Trains and John Lewis – and then selecting my AMEX card

£134.50

I tried my best to stick to spending that I was doing already but I understand that others could get much better value. Here’s a list of some of the offers that are currently available that interest me:

Harvey Nichols

Spend £200 get £20 back

The Ivy Collection

Spend £120 get £20 back

LNER

Get 10% back every time

Adobe

Spend £19 or more, get £10 back monthly

Discover Cars

Spend £100 get 10% back

One Aldwych

Spend £600 get £150 back

Homes & Villas by Marriott

Spend £500 get £150 back

Hilton

Spend £500 get £150 back

Marriott Bonvoy

Spend £200 get £50 back

World Of Hyatt

Spend £200 get £50 back

Onefinestay

Spend £1000 get £500 back

As you can see, if you book with these kind of brands already then there’s some huge value here. My problem is I’m too much of a cheapskate – haha!

Dining credit

When these offers were announced I was like – THIS IS RIGHT UP MY STREET. You can find all the restaurants included here – theres over 1400 to choose from and not all are really expensive though most are pretty swanky. You can use the credit at multiple places – you don’t need to spend it in one go.

Here’s how I used mine:

Date

Perk

Restaurant

Value to me

Sep ’21

Get 100% back every time up to £200

Roka, London

I had booked their pre-theatre menu already for James’ birthday meal however this meant we could really take the meal to the limit with lots of cocktails!!

We spent £199.70 however it’s unlikely I would have spent that much without the card.

£150

Aug ’22

Get up to £150 back annually when you dine abroad

Mr Porter, Amsterdam

As this offer was announced with only a month to go on my year, this was the only trip we could use it on and everywhere else was booked up! The food was really good though, so I’m glad we got to use it.

We spent £150 – however again, it’s unlikely I would have spent the full amount without the card.

£100

N/A

Get up to £150 back annually when you dine locally

This sounds wild but… I didn’t use it in time. AND I LIVE IN LONDON. The issue is that I was going through a lot of health issues triggered by food in Aug and so I decided to leave it until I’d be able to properly enjoy it.

£0 – but I will get to use it

Harvey Nichols credit

Date

Value

Value to me

Would I have bought this normally?

Feb ’22

£50

£50

Yes – It was my birthday and I wanted to treat myself – ended up buying an absolute bargain in the sale so it made a very fancy dress for only £25!

July ’22

£50

£40

Yes – We bought 2 bottles of gin but had to pay a delivery fee and it was slightly more pricey than other sites, so that’s why £10 has been deducted.

Addison Lee credit

I used this once but the taxi was £10 more expensive than another option anyway. Seemed a very London-centric perk and not one I used due to Addison Lee’s expensive price! Therefore, I didn’t get any value out of this perk.

Platinum concierge

I only tried using this a couple of times for dinner reservations and unfortunately it didn’t prove too helpful – but if you were someone who does fancy dining quite often, it may be very helpful.

Feb ’22

I wanted to treat myself to a fancy breakfast for my birthday at The Worsley but they had no room – I thought I’d try AMEX concierge to see if they could open anything up but they couldn’t. I thought it was a great service though and loved that I didn’t have to call the restaurant myself! They did also offer to try other places for me but my plans changed.

Aug ’22

Trying to find somewhere to use the £150 dine abroad deal but they said they wouldn’t help unless our travel was booked with them! They just told us to try RESY.

I’m also aware that it can be great for help with travel plans – they act kind of like your own personal travel agent and say you wanted a hotel in Amsterdam for £100 a night, they could then come back to you and say what they had found. I think my problem is I love doing the searching for myself but if you don’t, this could be a really lovely perk.

Also, say you’d booked through them and then your airline cancelled your flight, they would be able to wait on the phone and deal with the airline on your behalf which I know lots of people would have really appreciated in the last year.

Worldwide travel insurance

I already had annual travel insurance when I joined and so this was not a perk to me until that ran out in April 2022. Therefore, I’ve prorated this to a value of £7 but if you don’t have travel insurance sorted, it’s a great perk!

Other

Item

Perk

Value to me

Sixt Car Hire

Booking with AMEX Platinum Card means you get liability insurance on car hire which we’d normally pay for independently through a third party.

£10

How many AMEX membership points did I earn in one year?

Welcome Bonus

65,000 points

1 Point for every £1 spent

11,000 points

Referral Bonus

24,000 points (for 1 referral)

TOTAL

100,000 points

I’ve already included the ‘value’ of the bonus 65,000 points in my calculations above (at least £292.50) and so using the same maths, the additional 35,000 points will be worth at least £157.50 if I was to simply use them to pay at a retailer I already use.

However, I hope to instead use my points to book travel but for that, I need a little help on what I could do with 100k AMEX points.

What can I do with the AMEX membership points that I’ve earned?

There’s lots of ways you can use your AMEX membership points but the widely accepted best value way to do it is to use it to book flights – though remember you’ll still have to pay taxes and fees on reward flights.

I’m very new to the points and miles game and so thankfully, my wonderful friend Dan who is somewhat of an expert in this area, has stepped in to tell me what options he think would work well for me.

“100,000 Membership Reward points is a great amount to have sitting in your armoury

One of my favourite things about Membership Reward points is that you can transfer them to no less than 12 airline loyalty programs. That means even if you’ve never flown with the airline before, you can use points to fly them for next to nothing.

While you could do several return economy trips with that amount of points, I never recommend using points to redeem long haul economy as you can sometimes end up spending more in terms of cash equivalent due to the taxes and fees you’ll be charged.

Top 100,000 point redemptions for you are:

1. Transfer your points at 1:1 to Virgin Atlantic’s Flying Club and fly return with Virgin in Upper Class (business class) to the U.S. for 95,000, Atlanta, Boston, Miami, New York, Orlando, and the brand new destination of Tampa

2. Transfer your points at 1:1 to BA’s Executive Club BA City breaks: 10 economy returns (~10,000 Avios return) to European cities like Amsterdam, Copenhagen, Milan, Munich, and Paris (or 5 city breaks in business class)

3. Transfer your points at 1:1 to Emirates Skywards: and fly from London to Dubai return in Emirates business class on the A380 for just 90,000 Skywards miles.”

Thanks Dan! Make sure you give him a follow if you want to know more about this kind of thing.

Summary of the total value I got from my AMEX Platinum Card in one year

In summary, I got at least £1107 of value from my first year of having an AMEX Platinum Card. Taking away the £575 fee, that means I got a ‘free’ £532 of value.

In addition, it’s very likely I’ll use my 100k AMEX points for reward flights and so I should get even more value.

So overall, I’ve been really happy with it and I’m glad I took the punt!

What I liked about the AMEX Platinum Card

- I got more value out of it than I put in!

- It made my travel days much more enjoyable thanks to the lounge access

- I’ve been able to stay in nicer places for the same cost that old me would spend

- Peace of mind from having solid travel and liability insurance

- I’m not gonna lie, having a metal AMEX card is cool as fack

- I will be able to use my points to fly long haul business class in the future which is something I never thought I’d be able to do!

What I didn't like about the AMEX Platinum Card

- Fees on foreign transactions

- For a card supposedly built for travellers, it’s disappointing that there’s fees when you are buying things when abroad! Especially when there’s lots of free prepaid and debit cards on the market that do this for free

- You can’t use an AMEX everywhere

- In general, it’s pretty usable in London but there have been plenty of times when its been denied – the biggest issue I’ve had is that it wasn’t allowed to be used at a car hire company (even after I’d reserved it online using my AMEX) which meant that the car wasn’t covered by the included liability insurance. One to watch out for!

- It’s was charge card rather than a credit card (though this has changed since!)

- Some places may not accept it for holding an amount on your card and also, your purchases won’t be protected by Section 75 though AMEX do have their own protection policies. However, as of August 2022, the AMEX Platinum Card has changed to a credit card and so this shouldn’t be a negative for you.

- It made me spend more money

- As you get your statement once a month, I definitely found myself using the card a bit ‘willy nilly’ and having to face a big ol’ number at the end of a month. You can avoid this if you’re really hot on moving money into a pot every time you spend but I was not and I can really see how easily you could get yourself into trouble if you’re not strict.

- It tempted me away from the cheapest option

- Not always, but the draw of a ‘free upgrade’ or the knowledge of getting a decent amount of cashback meant I often found myself looking at more expensive travel plans due to the card. Sure, it means I got a higher level of travel but it shouldn’t be forgotten that it cost me more versus my old self

- I kept forgetting that the perks aren’t free

- It’s really easy to think you’re getting a £200 meal for free but… You’re not. You’re paying £575 a year for the privilege and so you have, for at least some of it, paid. It’s really easy to forget this.

- The lounge access isn’t guaranteed

- A few times, when I was travelling in peak periods, the lounge was ‘full’ and not accepting Priority Pass/card holders. I always managed to get in after 30 mins but by that point, I’d often spent money elsewhere.

- You have to read the terms and conditions

- This is a recent example but let’s just say I booked a very expensive restaurant to use mine and James’ local dining credit on. However, in the 7 days between booking and eating, the restaurant got taken off the list of available restaurants meaning James and I spent £250 OURSELVES. Fortunately, we were able to appeal to AMEX’s kind hearts and get it included in the deal still but yeah, it took a lot of negotiation so read those terms and conditions closely.

Is the AMEX Platinum Card worth it for the average traveller?

First we need to revisit the perks as they have changed slightly since I signed up:

- Welcome bonus: 65,000 bonus Membership Rewards points when referred as long as you spend £6000 on your card in the first six months (35k if no limited offer available)

- Welcome bonus: £200 credit towards a getaway booked with Amex Travel Online as long as you spend £6000 on your card in the first six months

- Earn 1 Membership Points for every £1 spent and 2 for every £1 spent at amextravel

- Complimentary access to over 1400 airport lounges

- AMEX Rewards offers

- Hotel and car hire benefits

- £300 dining credit – £150 to be spent abroad and £150 to be spent in the UK

- £50 free credit to spend at Harvey Nichols, twice a year

- Hotel Benefits including complimentary room upgrades

- Platinum Concierge for travel plans, tickets and dinner reservations

- Worldwide Travel Insurance

I’m also going to list what value these perks would have for me going into my second year based on last year’s usage.

Perk

First Year Value (for average traveller)

Second Year Value (specifically for me!)

65k / 35k points

£292.50 / £157.50

N/A

Amextravel credit

£200

N/A

Membership points

From £27 (based on £6000 spend)

£49.50 (based on £11k spend)

Hotel and car hire benefits

From £0

£0

Lounge Access

£84 (based on 7 solo visits valued at £12 each)

£165.50

AMEX Offers

From £0

£134.50

Local Dining Credit

£150

£150 (though I have an extra £150 to spend as I didn’t use it up in my first year)

Global dining credit

£150

£150

Harvey Nichols credit

£100

£100

Platinum Concierge

N/A

N/A

Travel Insurance

£40 (based on general annual policy cost)

£40

£1043.50 / £908.50

£789.50

Based on this, I do think the AMEX Platinum Card is a good value option for the average traveller for the first year – even more so if you travel often with someone else and could also share the fee with them.

However – the big question to ask is whether it’s realistic for you to be able to charge £6000 to your card in the first six months – granting you the welcome bonus points.

If no, then you start getting close to the yearly fee and also, please remember the fee will never be worth it if you end up spending extra money just to simply reach the £6000 threshold.

Please – if you don’t have £1000 of spend that you could put on an AMEX a month and you know you could be tempted to spend more to do so – do not get this card.

It is only worth it if you use it in line with your current spending habits.

As for the second year and onwards, that’s where I think you need to look at what value you’ve genuinely got from your first year and work out if it makes sense for you – bearing in mind that there are free cards on the market where you can earn 1 points per £1 spent.

Will I be continuing to pay £575 a year?

Based on the values shown above, I do think it’s worthwhile for me to continue using the AMEX Platinum Card for a second year.

However… As you may have spotted above, I have actually referred one person already. That person is my boyfriend James and so I will get a supplementary card which will give me access to lounges, AMEX offers and worldwide travel insurance.

If you take those values away, having my own card leaves me with £449.50 of value. When you also factor in that there are other cards that could give me a 1 point for £1 spent value for free, this comes down to £400 making the card not worthwhile in my specific circumstances.

Therefore, I will be cancelling my card.

But… not just yet.

My plan will be is to continue with the card so that I can use my outstanding £150 dining credit and also allow for £300 dining credit to reset in January 2023. In addition, my Harvey Nichols credit will also reset to the value of £50 so I’ll get good value out of that too before I cancel it early next year.

I won’t lose out on the fee because you can actually call up AMEX and ask to pay this pro-rata at £47.92 a month – and so that is what I’ll do.

Quite simply, I don’t think it makes sense for both people in a couple to have the AMEX Platinum Card and actually, having one card for two people in this way is a fantastic way to get great value out of it.

Who else do I think will benefit from this card?

Just because the card has worked for me it doesn’t mean it will work for you too.

Hopefully you’ve been able to see what value you’d be able to get from it from my very detailed breakdown, but in summary here’s who else I think it could work for:

- Anyone who travels more than 10 times a year

- A couple who travel together at least 5 times a year – or where both partners travel a lot independently

- Anyone who can charge the steep fee to their business (worth a try!)

- Anyone who is a loyal customer to any of the Rewards Programmes involved including Marriott, Hilton and Radisson

- Anyone who already spends hundreds of pounds a year on fine dining restaurants in major cities in the UK and abroad

How to get an AMEX Platinum Card referral link

So if you are interested, I’d definitely recommend getting referred since that’s often the way to get the best Welcome Bonus.

Very simply you need to find someone who already has an AMEX that can refer you. The great news is that anyone in this situation will be happy to do so as it normally means they earn points!

AMEX stipulates that you can’t be posting your referral link online – it’s a refer a friend scheme after all – but if you are indeed my friend over on Instagram, feel free to drop me a DM and I can send you my link, or fill in this form and I’ll email you it.

Otherwise, ask around for your friends and family to see if anyone can help you out!

What other cards offer similar benefits?

Once I’ve closed my account, my plan is to open a new card that will help me continue earning points.

For the AMEX options, I wouldn’t be eligible for the welcome bonus points as I’ve had an AMEX account in the last 24 months.

Other American Express Credit Cards

Cards

Info

- AMEX

- Credit card

- No yearly fee

- Collect 5000 bonus Avios when you spend £1000 in your first 3 months of membership

- Earn 1 Avios on every £1 spent

- Get a Companion Voucher when you spend £12,000 each membership year on the Card, which you can use to either take a companion with you on the same flight and cabin or, if travelling solo, a 50% discount on the Avios price you pay for your flight. Vouchers are redeemable when you book a British Airways Reward flight in Euro Traveller and World Traveller cabins (economy class) only.

- AMEX

- Credit card

- £250 annual fee

- Collect 25,000 bonus Avios when you spend £3000 in your first 3 months of membership

- Earn 3 Avios on every £1 spent with British Airways or BA Holidays

- Earn 1.5 Avios on every £1 spent

- Get a Companion Voucher when you spend £10,000 each membership year on the Card, which you can use to either take a companion with you on the same flight and cabin or, if travelling solo, a 50% discount on the Avios price you pay for your flight.

- Complimentary supplementary cards

- Travel protection

Barclaycard Avios Credit Cards

Cards

Info

- Mastercard

- Credit card

- No yearly fee

- Collect 5000 bonus Avios when you spend £1000 in your first 3 months of membership

- Earn 1 Avios on every £1 spent on eligible purchases

- Get a British Airways cabin upgrade voucher when you spend £20,000 within 12 months

- Get up to 5 months of Apple Music, Apple TV+, Apple News+ and Apple Arcade

- Mastercard

- Credit card

- £20 monthly fee

- Collect 25,000 bonus Avios when you spend £3000 in your first 3 months of membership

- Earn 1.5 Avios on every £1 spent on eligible purchases

- Get a British Airways cabin upgrade voucher when you spend £10,000 within 12 months

- Complimentary supplementary cards

- Get up to 5 months of Apple Music, Apple TV+, Apple News+ and Apple Arcade

I was going to say that I think the British Airways AMEX without the yearly fee feels like a good fit as once James has earned from his Platinum Card for a year, we’re going to have around 200k points and so being able to use a Companion Voucher on top of that could mean we could really spoil ourselves!

However, one of you has kindly pointed out that in the terms they will not allow you to use the voucher on long haul business class – rubbish!! Therefore, perhaps the Premium Plus Card may swing it for me…

I’d love to hear which ones you’d recommend for my year ahead!